Does Long Term Debt Makeup Equity

What is Long-Term Finance?

The funds that are not paid back within less than a year are referred to as long-term finance. Sure long-term finance options directly grade a part of the permanent capital of the firm. In such cases, the repayment obligation does non even arise. A 20-year mortgage or 10-twelvemonth treasury bills are examples of long-term finance. The main purpose of obtaining long-term funds is to finance uppercase projects and carry out operations on an expansionary scale. Such sources of finance are normally invested into avenues from which greater economic benefits are expected to arise in the futurity.

Sources of Long Term Finance

The nature of such finance tin can exist ownership and borrowing or a hybrid of the two. Some of the chief sources of long-term finance are listed below.

Table of Contents

- What is Long-Term Finance?

- Sources of Long Term Finance

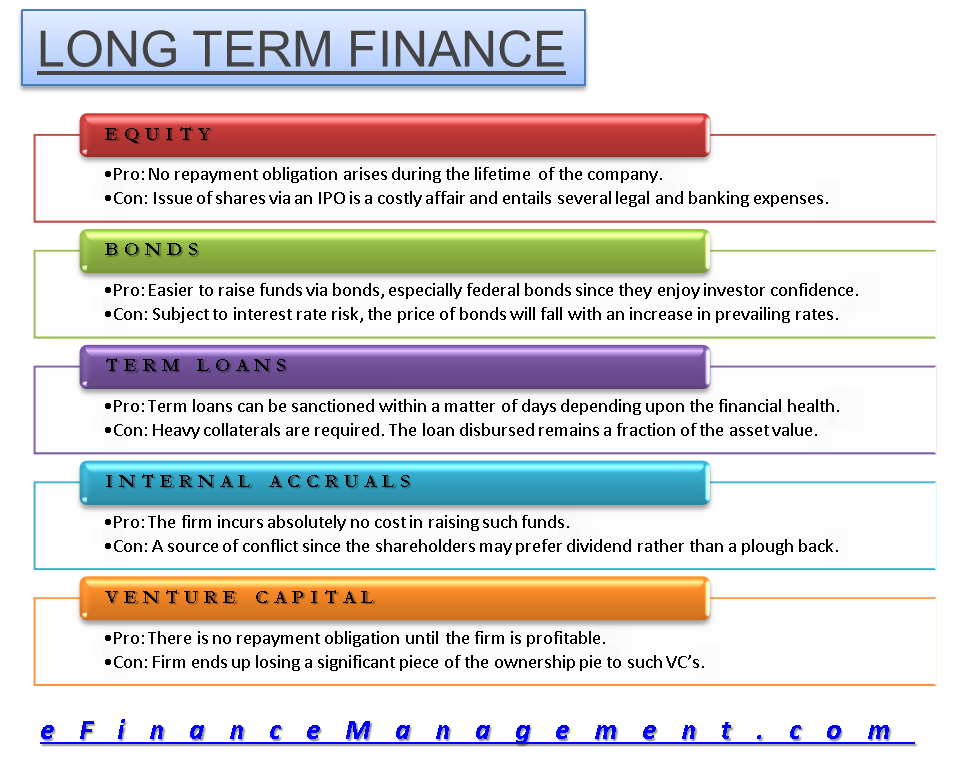

- Equity

- Bonds

- Term Loans

- Internal Accruals

- Venture Capital

- Curt Term Vs. Long Term Finance

Equity

Equity is the foremost requirement at the time of floatation of any company. They represent the ownership funds of the visitor and are permanent to the firm's upper-case letter construction. The equity can exist private or public. Private disinterestedness is raised from institutional or loftier-net-worth individuals. Public equity is raised by issuing shares to the public at large, which are subscribed to by retail investors, mutual funds, banks, and a pool of other investors. On the flip side, equity is an expensive variant of long-term finance. Investors look a loftier return due to the extent of take chances involved.

- Pro: No repayment obligation arises during the lifetime of the company.

- Con: The issue of shares via an IPO in the primary market is plush and entails several legal and banking expenses.

Bonds

Bonds are debt instruments involving two parties- the borrower and the lender. The borrower can exist the government, a local torso, or a corporation. They provide fixed interest payments at periodic intervals and are redeemable at a predetermined date in the future. Bonds are unremarkably issued confronting collateral and are therefore a highly secured class of long-term finance. Bonds may prove to exist a very cost-effective source of funds in a bullish market place.

- Pro: It is easier to heighten funds via bonds, especially federal bonds since they enjoy complete investor confidence.

- Con: Field of study to involvement rate risk. Therefore the price of bonds will fall with an increase in prevailing interest rates.

Term Loans

Term loans are borrowings made from banks and financial institutions. Such term loans maybe for the medium to long term, with a repayment period ranging from i to 30 years. Such long-term finance is by and large procured to fund specific projects (expansion, diversification, uppercase expenditure, etc.) and is, therefore, also known equally projection finance. Term loans can be sourced by both pocket-size as well as established businesses. Also, the interest rates are relatively low and are negotiated depending upon the duration of the loan, nature of security furnished, the risk involved, etc.

- Pro: Term loans tin exist sanctioned immediately within a affair of days depending upon the firm's financial wellness.

- Con: Heavy collaterals are required to exist furnished to obtain a term loan. Even and then, the amount of loan disbursed remains a fraction of the asset value.

Internal Accruals

Internal accruals are naught but the reserve of profits or retention of earnings that the firm has created over the years. They represent i of the about essential sources of long-term finance since they are non injected into the business from external sources. Instead, information technology is cocky-generated and highlights the sustainability and profitability of the entity. Also, internal accruals are the owner's funds and therefore create no accuse on the visitor's assets.

- Pro: The business firm incurs absolutely no price in raising such funds.

- Con: It may be a source of conflict since the shareholders may prefer the payout of dividends rather than a plow dorsum.

Venture Majuscule

This class of financing has emerged with the growing popularity of start-up culture worldwide. Venture Capital (VC) firms invest in companies at their inception or seed phase. They are constantly on the sentry out for firms demonstrating high growth potential. Their investment takes the form of ownership funds and forms a part of the house's permanent capital. Venture capitalists also have a predetermined get out strategy before they invest. This results in the target company beingness listed or a secondary sale to another VC firm.

- Pro: The companies that are yet to constitute steady cash flows are not burdened past any covenants which entail debt financing. There is no repayment obligation until the house is profitable.

- Con: The business firm ends up losing a pregnant piece of the buying pie to such Vc's.

Short Term Vs. Long Term Finance

A comparative analysis of curt and long-term financing will farther assistance in effectively grasping the benefits of long-term finance. Short and long-term sources of finances cater to a different gear up of requirements for different borrowers. The tabular array below illustrates some points of stardom.

| Short-Term Finance | Long-Term Finance | |

| Duration | Typically repayable within i year or less. | Take a longer time bridge varying from i to thirty years. |

| Requirements | Obtained to fund a temporary shortfall in the working capital, repayment of current liabilities, etc. | Obtained to fund the purchase of PPE or capital projects on a wide calibration. |

| Collaterals | Practise not create a charge on the assets of the business firm. | Collaterals are the most primary condition for the furnishing of long-term finance. |

| Terms of loan | Interest rates are unstable and are vulnerable to inflationary forces. | Involvement rates are stable, and the loan terms offer flexibility such equally prepayment options, re-negotiation of interests upon improvement in credit rating, etc. |

| Volume of funds | Used to raise funds in express amounts since they are repayable in the near time to come. | A big volume of funds can exist obtained. All the same, the aforementioned is restricted to the nature of securities furnished, the credit rating of a borrower, etc. |

| Examples | Overdraft, Credit Cards, Line of Credit. | Leasing, Term Loans, Public Deposits, Bonds. |

Source: https://efinancemanagement.com/sources-of-finance/long-term-finance

Posted by: ethertoncalawn.blogspot.com

0 Response to "Does Long Term Debt Makeup Equity"

Post a Comment